Get Your Share of Fiduciary Peace of Mind.

All the Key Features.

One Integrated Interface.

Get Started with PlanAdvisor Today!

Focused on you.

We empower financial services professionals to save time and money with fully streamlined and integrated workflows. By helping you fulfill your fiduciary duties and better manage your involvement in the benefit administration function, you can forge stronger relationships and grow your business.

Financial Advisors & RIAs

- One click access to integrated Morningstar, recordkeeper, custodian and trading data

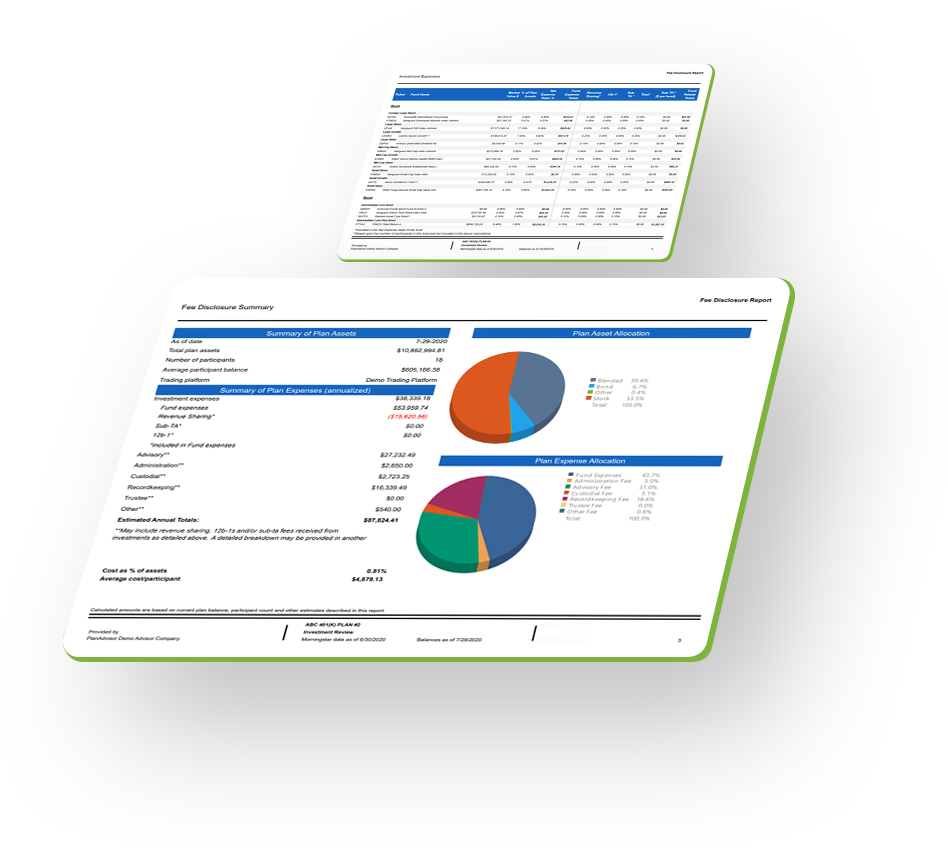

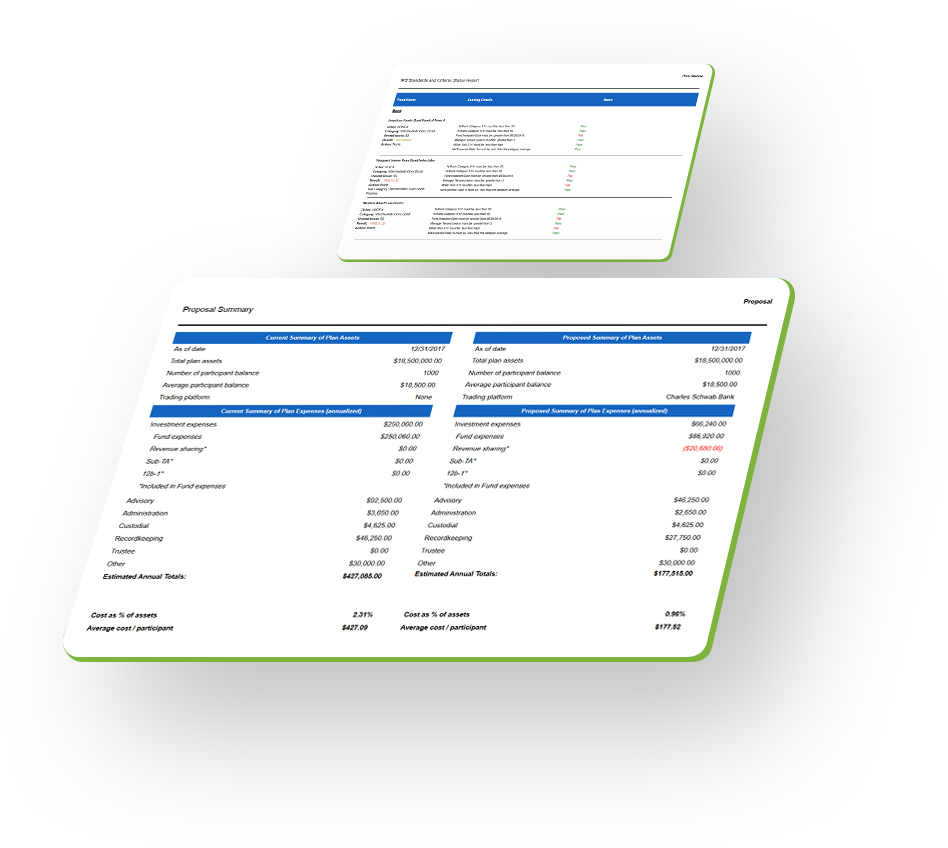

- Easily create and customize reports and proposals for new, current and takeover plans

Recordkeepers & TPAs

- Easily create reports to satisfy 408(b)(2) compliance that include expenses, fees and more

- Efficiently create fee benchmarking reports that include fees, investment quality and more

Our pledge. Your peace of mind.

Customer service sets us apart from most SaaS firms. Why? Because our helpdesk is monitored by our experienced team of industry professionals that understand our customers’ unique needs.

Resources

Top 3 Considerations for Choosing a SaaS Retirement Plan Solution

Selecting a Software-as-a-Service (SaaS) retirement plan solution is a critical decision for any organization seeking to efficiently manage employee retirement benefits.

4 Ways Retirement Plans Saas Ensure Fiduciary Peace of Mind

Retirement Plan SaaS (Software as a Service) solutions play a critical role in helping businesses manage their retirement plans efficiently.

Elevate Your Business: The Power of Choosing the Right SaaS Solution

In today’s rapidly evolving business landscape, staying ahead of the competition requires leveraging cutting-edge technology. One such technology that has revolutionized the way businesses operate is Software as a Service (SaaS). By choosing the right SaaS solution,

Take your business to the next level, and start saving time, money & resources.

Request private demo.

“PlanAdvisor is built to help our clients streamline operations, better address new business opportunities and save money. We’d love to help you.”

– Founder